ING Digital Bank

Have you seen the tv-commercial between two individuals who are dressed up as an orange dragon that is identical which on their first eye contact immediately felt the connection or the “Zing”? Its an Advertisement for the Company Named ING Bank. Though I don’t really understand what the commercial is trying to convey, I thought ING Bank is a new player in the banking industry here in the Philippines until late this afternoon when I am walking in SM Megamall did I saw the familiar ING Logo with the orange Lion. Since I am not really in a hurry, I slowly approach their booth to ask bits of info to widen my idea of the bank. When Ate girl smiles at me and she said it’s a digital bank, I got interested since this is another clear technology that I must try out. I am not new to digital banking my 1st Digital bank app is with CIMB which I think came in the Philippines late 2018 or early 2019. What got me interested in ING bank this afternoon is the freebies which I will be discussing later on.

Now what does ING Bank stands for and where was it originated? According to a few searches I made when I arrive home, ING is an abbreviation for Internationale Nederlanden Groep (in English: International Netherlands Group) and the orange lion on its logo alludes to the group’s Dutch Origins and the bank was established in 2012. On their app, they further said that they are operating to date in more than 40+ countries across the world servicing more than 37.5 million people every day. They also have been chosen as the Best Global Bank by the Financial Times and that they take pride in developing products and services that meet their customers’ needs. I was initially given a brochure by ING’s product associate and I was impressed by its Highlighted features namely:

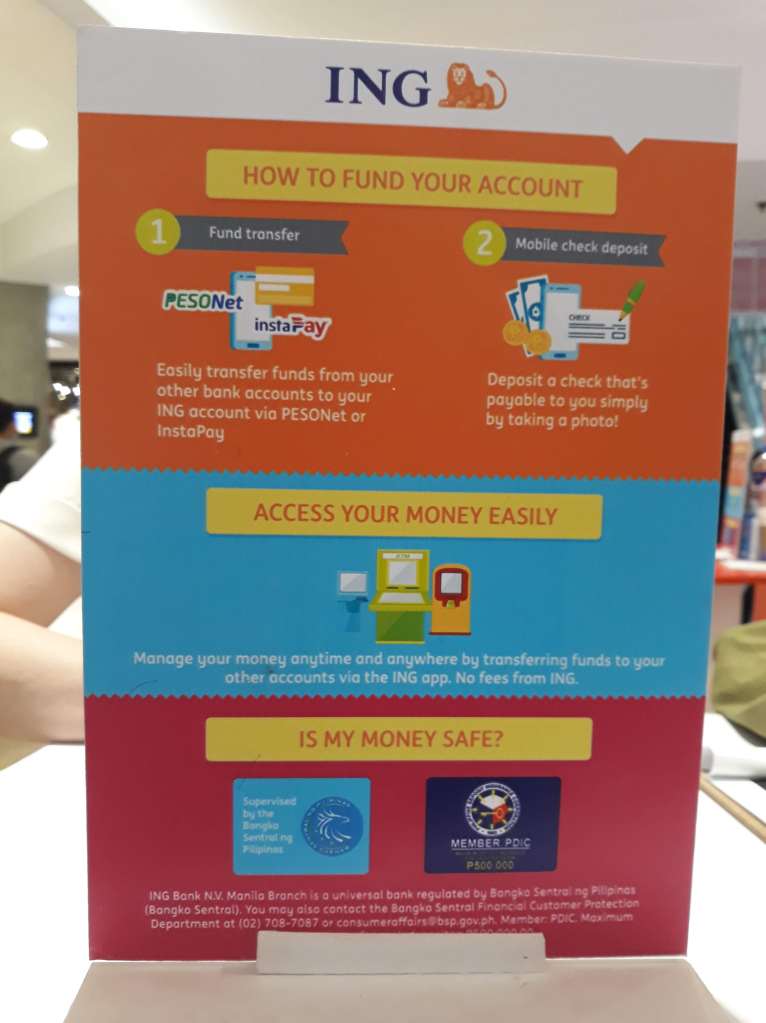

- 4% interest rate per annum

- NO minimum and NO maintaining balance to worry about, NO minimum amount to open an account

- No Lock-in period which literally means I can, at any given time withdraw portions or the full amount I deposited to their app.

- Take a photo of the Check you want to deposit which means No lines, No paper forms and No visit to a Physical Bank

- The power to transfer money to any Philippine Bank which has Zero Fees from ING (wow!!!)

- The power to use INSTAPAY and PESONET in making bank transfers

- They have a literal 24/7 customer chat support service

Having read the above features, the customer associate further said that I can download the app in App Store or GooglePlay and was about to leave when she said if I made the downloading and registration at their booth they will give me 200 pesos worth of Starbucks Gift check. Since I am not really in a hurry, I told myself this is simple and got nothing to lose. She even told me I can connect with their Wifi if I needed to but I just told her I will just be using my mobile data. The UI (user interface) of the app is quite nice. It is actually simple without unnecessary design or irrelevant buttons. The simplicity of the design is not intimidating especially to a non-technical person. In my humble observation, I just feel the responsiveness of their app during the registration process is not that finesse. It lags a few times and/or has a touch-sensitive requirement that restricts the user to only touch “once” to the chosen item (city where I was born) and if you did touch the selected city twice, the system will have an error which means I need to re-encode again the ID number, expiration, address (including the choice of the city) which I think is too strict. Anyway, kudos to their data privacy statements as well as the self-image capturing and signature uploading. When I was about to finish the registration. The customer associate told me how easy it is to deposit to my ING account and that, she further said if I will deposit now at least 1000 pesos, she will give me 400 worth of Sodexo gift check which kept me thinking that I can have a combined gift check equivalent of 600 pesos before I leave their booth. When I did manage to make fund transfer from my PS bank mobile app, which is fast, convenient and easy and have them verify the new account balance, the Sodexo gift check was given. Out of my curiosity, I ask them if I can also make some referrals which they said that if a make 10 referrals they will give me a Bluetooth speaker. So I inquire further about it and was given the referral card. My excitement in referring cools down when they said that my referee should be given the referral card one at a time until all 10 blocks have been crossed-out. I told them it is a bit impossible to do that and even suggested they use referral QR codes or numbers in order to determine who refers to who but they said they do not have that kind of thing now. Anyway, I still promoted the ING app to my friends even though I am not qualified for the Bluetooth speaker, I can easily attract users by the sheer 600 pesos worth of freebies. I am now making myself familiar with the buttons of the app and I can initially say that I think I will be using this app for peso savings.

600 worth of Gift Check

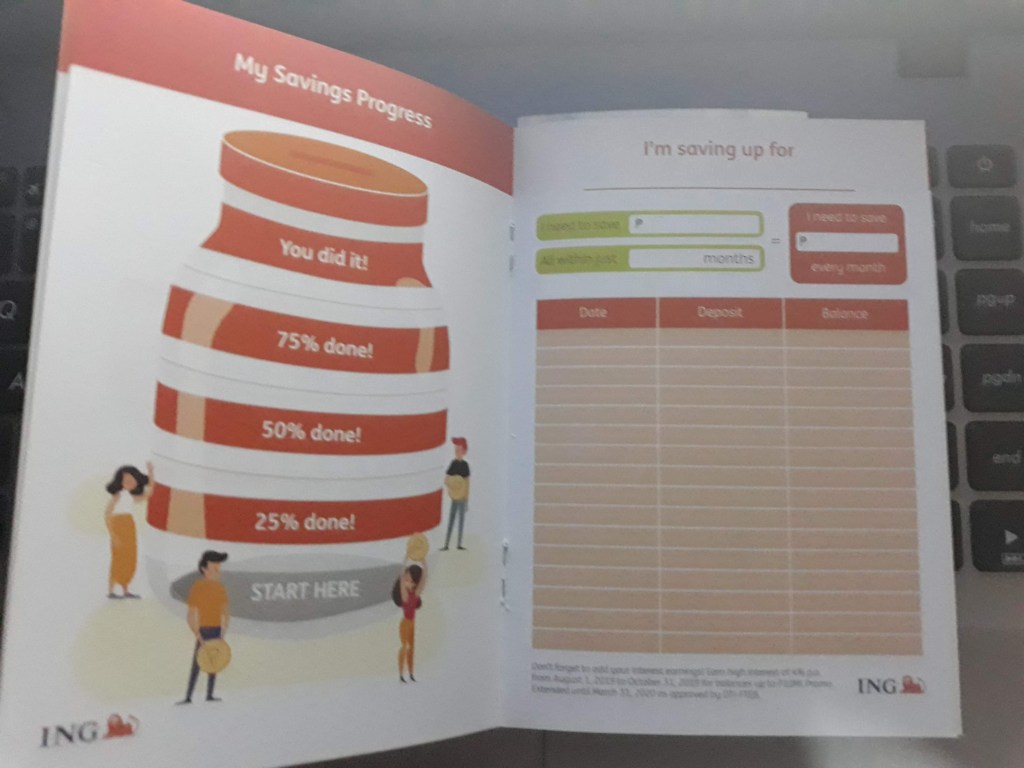

By the way, I almost forgot, they also gave me the ING starter Kit for me to easily navigate with the app. I must say he portion on how to help me to save is quite encouraging for me to save up. If you happen to be in SM Megamall, you can find them on the ground floor, building A, few steps away from El Pollo Loco. The booth will run until April 3, 2020. I think similar booths are scattered around key Malls in the Philippines so just be sure to look for the ING Logo if you happen to visit any malls.

What’s your experience with the registration process and the App in general?

techforwealth